Trade Daily Leverage Certificates with Phillip Capital

Enjoy zero platform fees and conveniently trade DLCs across multiple devices with our multi-platform support

Daily Leverage Certificates

Daily Leveraged Certificates (DLCs) are structured financial instruments issued by banks and traded on the securities market. They provide investors with the opportunity to capitalize on both rising and falling markets, offering fixed leverage ranging from 3 to 7 times the daily performance of the underlying asset, calculated on a daily basis. For instance, if the underlying asset moves by 1% from the previous trading day's closing price, the value of a 5x DLC will change by 5% (before costs and fees). Common underlying assets include market indices or individual stocks.

Why trade DLCs with Phillip Capital?

-

We are your trusted broker

Phillip Capital Sdn Bhd was established on October 7 1995 and holds a Capital Markets Services License to offer securities -

No platform fees, no custodian fees

Save on your trading and investing costs! -

Personalised Interface with Integrated Trading Tools

Mix and match, re-arrange and customise your workspaces exactly how you want them.

-

Analytics

Insightful analytical data and company valuation to help you pick the right trades -

Global Chart Live

A suite of valuable charting features equipped for all kinds of technical analysis -

Multi-lingual Interface

Get market updates from a wide range of news sources and receive news according to your preferred counters in Watchlists

*Available in English & Chinese

What are Daily Leverage Certificates (DLCs)?

Watch a full introductory webinar to know what DLCs are!

DLCs Trading Platform

Poems Global MY 3.0

We are thrilled to inform you that POEMS Global MY 3.0 is now readily accessible for download on both mobile and desktop. With its diverse essential features, POEMS Global serves as the perfect tool to assist investors in making informed trading decisions.

Frequently Asked Question

Daily Leveraged Certificates (DLCs) are structured financial instruments issued by banks and traded on the securities market. They provide investors with the opportunity to capitalize on both rising and falling markets, offering fixed leverage ranging from 3 to 7 times the daily performance of the underlying asset, calculated on a daily basis. For instance, if the underlying asset moves by 1% from the previous trading day’s closing price, the value of a 5x DLC will change by 5% (before costs and fees). Common underlying assets include market indices or individual stocks.

DLCs are intended for investors who can accept the risk of significant losses, potentially up to the full principal amount in a short time. Investors should have a thorough understanding of the product and either extensive knowledge or experience in trading to assess the structure, risks, costs, and returns. DLCs aim to deliver short-term results by amplifying the daily performance of the underlying asset.

Due to their complexity and high risk, DLCs are only suitable for those with knowledge of advanced financial products and a high risk tolerance.

Characteristics of DLCs

- Fixed leverage of 3, 5 or 7 times

- Relatively low capital outlay and loss is limited to amount invested

- Traded on exchanges with transparent pricing and structure

- No margins required

- No implied volatility impact and time decay impact

Features of DLCs:

- Trade in Both Bull and Bear Markets: DLCs offer two types—long and short—allowing investors to profit from both rising and falling markets. A long DLC benefits from rising prices, while a short DLC benefits from falling prices.

- Limited Lifespan: DLCs have a finite lifespan, with the final value automatically paid out at expiry. On SGX, DLCs have a maximum tenure of 3 years

- Compounding Effect: When held for multiple days, the return of a DLC may vary from its leverage factor due to the daily price reset, which aligns with the underlying asset’s closing level from the previous trading day.

Airbag Mechanism:

DLCs include an airbag mechanism to slow losses during extreme market conditions, triggered by a set percentage movement in the underlying asset. However, the airbag does not guarantee the DLC won’t lose its entire value.

The table below illustrates the air bag trigger thresholds of different DLC types:

| 3x DLC | 5x DLC | 7x DLC | |

|---|---|---|---|

| Underlying Index | 20% | 10% | 10% |

| Underlying Stock | – | 15% | – |

The airbag mechanism is triggered only when the underlying index moves against the direction of the product. For example, a 20% drop in the index will trigger the airbag for a 5x Long DLC, but not for a 5x Short DLC, and vice versa for a 20% rally.

Airbags are triggered only during the trading hours of the relevant stock exchange. For instance, DLCs on the Hang Seng Index or S&P 500 Index will have airbags triggered during HKEX or US trading hours, respectively.

Some DLCs may not have an airbag mechanism, or it may not activate in certain conditions. Investors should review the issuer’s listing documents for details on specific airbag mechanisms.

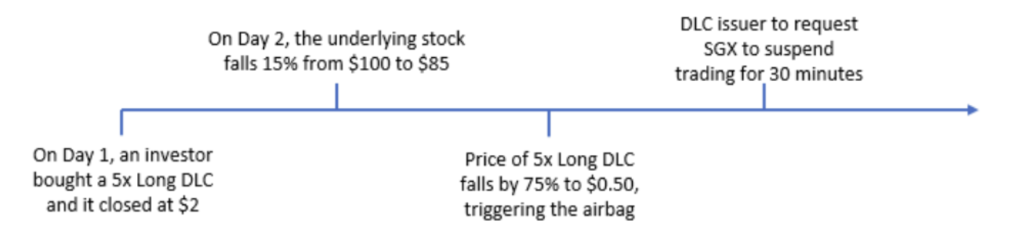

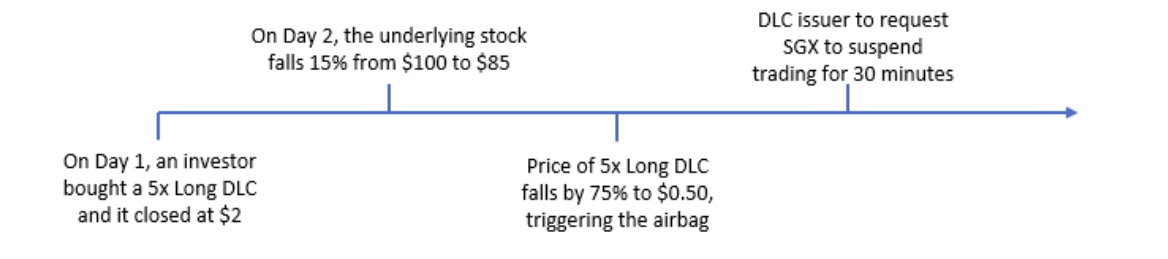

Below is an illustration of an airbag mechanism being triggered on a Single Stock DLC:

Trading will be suspended for 30 minutes when an airbag is triggered: 15 minutes of observation followed by 15 minutes of reset. After suspension, the performance of Long DLCs will be based on the lowest value, and Short DLCs on the highest value, during the observation period. This helps slow investor losses.

Continuing from the above example, assuming the NOL after suspension is at the airbag trigger point of 900 points, below is an illustration of the index falling after trading resumes on the same day.

Without the airbag, a 15% fall in the underlying index would lead to a 100% loss on the 7x Long DLC. If the asset rebounds after the airbag, it may work against investors, as gains are applied to the lower value of the asset, not the initial, higher value, limiting recovery potential.

Below is an illustration of an airbag mechanism being triggered on a Single Stock DLC:

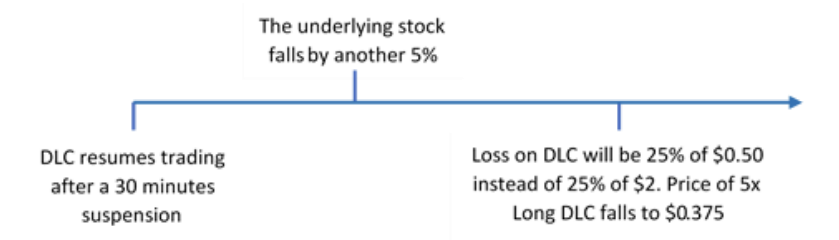

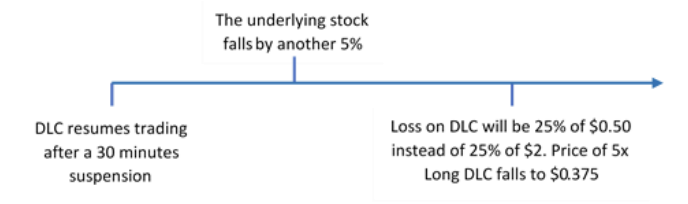

Continuing from the above example, below is an illustration of the stock falling after trading resumes on the same day, assuming NOL at $85.

Without the airbag mechanism, an additional 5% fall in the underlying stock would have left the DLC worthless. This is because the total fall of 20% in the underlying index would result in a 100% loss on the 5x Long DLC.

SGX typically uses the below convention for DLCs.

Example: DBS 5xLongSG250226U$A

| Code | Description |

|---|---|

| DBS | Underlying asset |

| 5x | Leverage Factor |

| LONG | Whether the DLC is a Long or Short contract |

| SG | Issuer: SG = Societe Generale, UB = UBS AG, MA = Mirae Asset Securities (HK) |

| 230309 | Expiration date in YYMMDD |

| US$ | Trading currency: for non-SGD denominated DLCs |

| A | Serial Number: When an issuer lists more than one DLC with the same underlying asset and expiry date, the DLCs are distinguished by letters A, B, C and etc. |

Counterparty Risk:

DLC counterparty risk arises from the issuer or guarantor. If either fails to meet obligations, investors may lose part or all of their investment. Insolvency of a foreign issuer would be subject to foreign laws.

Market Risk:

Market price of DLCs is influenced by factors like the underlying asset’s level, volatility, liquidity, exchange rates, and issuer’s creditworthiness.

Capital Risk:

If the underlying asset’s value drops to zero, investors lose their entire investment. Airbag mechanisms offer no guarantee against complete loss, especially during extreme market movements.

Liquidity Risk:

DLCs may face poor liquidity with issuers as the main market participants, potentially increasing the bid-ask spread.

Exchange Rate Risk:

If the underlying asset is traded in a different currency, exchange rate fluctuations may affect the DLC’s value.

Leverage Risk:

DLCs with 3x, 5x, or 7x leverage magnify both gains and losses compared to direct investments in the underlying asset.

Compounding Effect:

Holding DLCs for more than a day leads to compounding, causing gains or losses to deviate from the asset’s leveraged performance, particularly in a sideways market.

Varying Trading Hours:

DLC and underlying asset trading hours may differ, causing potential price volatility when one is closed, and limited liquidity when the other is unavailable.

Trading Suspension:

If the underlying asset is suspended, the corresponding DLC will also be suspended.

Reduced Ability to Recoup Losses Post-Airbag:

After the airbag mechanism triggers, reduced exposure limits the ability to recover losses even if the underlying asset’s value rebounds.

Please see the examples below to understand how profit and loss for DLCs are calculated:

Profit Scenario

S/N | Description | Calculation |

A | Purchase 1,000 DLCs of Company ABC at SGD 0.50 each | Equity Required: 1,000 × SGD 0.50 = SGD 500 |

B | Commission paid for A | Commission payable: SGD 500 × 0.1% = SGD 0.50 |

C | Exchange fees liable for A | Exchange fees payable: SGD 500 × 0.005% = SGD 0.025 |

D | Sale of 1,000 DLCs of Company ABC at SGD 0.75 each | Proceeds: 1,000 × SGD 0.75 = SGD 750 |

E | Commission paid for C | Commission payable: 1,000 × SGD 0.75 × 0.1% = SGD 0.75 |

F | Exchange fees liable for C | Exchange fees payable: 1,000 × SGD 0.75 × 0.005% = SGD 0.0375 |

G | Net profit = A – B – C – E – F | SGD 498.69 |

Loss Scenario

S/N | Description | Calculation |

A | Purchase 1,000 DLCs of Company ABC at SGD 0.50 each | Equity required: 1,000 × SGD 0.50 = SGD 500 |

B | Commission paid for A | Commission payable: SGD 500 × 0.1% = SGD 0.50 |

C | Exchange fees liable for A | Exchange fees payable: SGD 500 × 0.005% = SGD 0.025 |

D | Sale of 1,000 DLCs of Company ABC at SGD 0.25 each | Proceeds: 1,000 × SGD 0.25 = SGD 250 |

E | Commission paid for C | Commission payable: 1,000 × SGD 0.25 × 0.1% = SGD 0.25 |

F | Exchange fees liable for C | Exchange fees payable: 1,000 × SGD 0.25 × 0.005% = SGD 0.0125 |

G | Net loss = A – B – C – E – F | SGD 499.21 |

*Please note the figures above are for illustration purposes only and may not reflect the exact amount

3x Long and Short DLCs on the Magnificent 7 US Stocks

- First-of-its-kind in Asia offering investors a fixed leverage exposure of 3 times the daily performance of the underlying stock (payoff is exactly the same as L&I ETFs that are growing in popularity in the US)

- Long-Short exposure to trade both market directions or for hedging purposes, and are tradable in both USD or SGD currency

- Asian-hour exposure to the Magnificent 7 Stocks to provide greater trading flexibility in the case of high-impact news during Asian hours (SGX 9am-5pm trading window)

- During Asian hours, DLC performance tracks the US stock price traded on Alternative Trading Systems and this underlying prices are available on our DLC website

Why trade DLCs with Phillip Capital?

Experience One of Malaysia’s Best Online Trading Platforms

Phillip Capital Malaysia is a leading online stock trading platform recognized for its diverse investment options, including stocks, futures, IPOs, warrants, and ETFs. Our platform provides extensive research resources and advanced trading tools, ensuring investors can make informed decisions.

With a user-friendly interface and 24/5 customer support, Phillip Capital is the go-to choice for those looking to trade stocks in Malaysia. Explore our offerings in futures trading in Malaysia and CFD trading in Malaysia. Open your free stock trading account today and take the first step toward achieving your financial goals!

Trade DLCs in Malaysia: Choose Phillip Capital as Your Trusted Broker

At Phillip Capital, we help traders achieve profitable investment outcomes with our top-rated services. Our online stock trading platform in Malaysia offers features like customizable watchlists, real-time data, and low commission fees, making it ideal for cost-conscious investors.

Join us on our trading platform in Malaysia and start your investment journey now! We also provide comprehensive educational resources and market insights to enhance your trading skills. Whether you’re a seasoned trader or just starting, Phillip Capital is committed to supporting your investment journey with the tools and knowledge you need to succeed.

By choosing Phillip Capital, you’re not just opening an account; you’re joining a vibrant community of traders and a leading stock broker in Malaysia. Connect with like-minded individuals, share insights, and benefit from our interactive forums and events designed to foster collaboration and growth in your trading journey.