Choosing the right online trading broker is one of the most crucial decisions for any investor. Whether you’re a beginner looking to buy your first stock or an experienced trader seeking low fees and advanced tools, the right broker can make all the difference in your trading journey.

Malaysia’s online trading landscape has grown significantly in recent years, with more investors turning to online investment platforms in Malaysia to access local and global markets.

However, with so many options available, how do you pick one of the best trading brokers in Malaysia that aligns with your investment needs?

This guide will walk you through the key factors to consider when selecting an investment broker in Malaysia and how to open a trading account online with confidence.

Understanding Online Trading Brokers

Before diving into the selection process, it’s essential to understand what an online investment Malaysia broker does and how they differ from one another.

An investment broker in Malaysia is a platform that enables investors to buy and sell financial assets like stocks, bonds, mutual funds, forex, and cryptocurrencies. Brokers provide the necessary infrastructure, market access, and trading tools to execute trades efficiently.

The two main types of online brokers you should know are full-service brokers and discount brokers. Full-service brokers offer a wide range of services, including research reports, investment advice, and managed accounts. These are ideal for investors who want professional guidance.

Meanwhile, discount brokers provide self-directed trading platforms with lower fees. They cater to active traders and those who prefer to make their own investment decisions.

The broker you choose will significantly impact the costs and potential returns for your trading account in Malaysia.

5 Essential Factors to Consider When Choosing a Broker

1. Trading Fees & Commissions

One of the first things to evaluate is the cost structure of a broker. Trading fees can eat into your profits, so it’s essential to compare the different types of charges like commission-based brokers and zero-commission brokers. Commission-based brokers charge a fixed fee per trade (e.g., RM8–RM25 per transaction). Zero-commission brokers earn through spreads, currency conversion fees, or other hidden costs.

Other fees to look out for include:

- Currency Conversion Fees – If trading foreign stocks (e.g., US or HK markets), some brokers charge up to 1% per conversion.

- Withdrawal Fees – Some brokers charge fees for withdrawing funds to your bank account.

- Inactivity Fees – Certain brokers impose fees if your account remains dormant for a set period.

💡 Tip: Choose a broker with transparent pricing and no hidden costs to maximise your returns.

2. Market Access & Investment Products

Your trading broker in Malaysia should offer access to a variety of markets and investment products.

Make sure you ask the following questions:

- Can you trade on Bursa Malaysia, the US stock market, Hong Kong stocks, ETFs, or forex?

- Does the broker offer diverse investment products? We’re talking stocks, bonds, mutual funds, options, commodities, and cryptocurrencies.

A well-diversified portfolio is essential for managing risk, so having multiple investment options within a single platform can be a game-changer.

3. Trading Platform & Technology

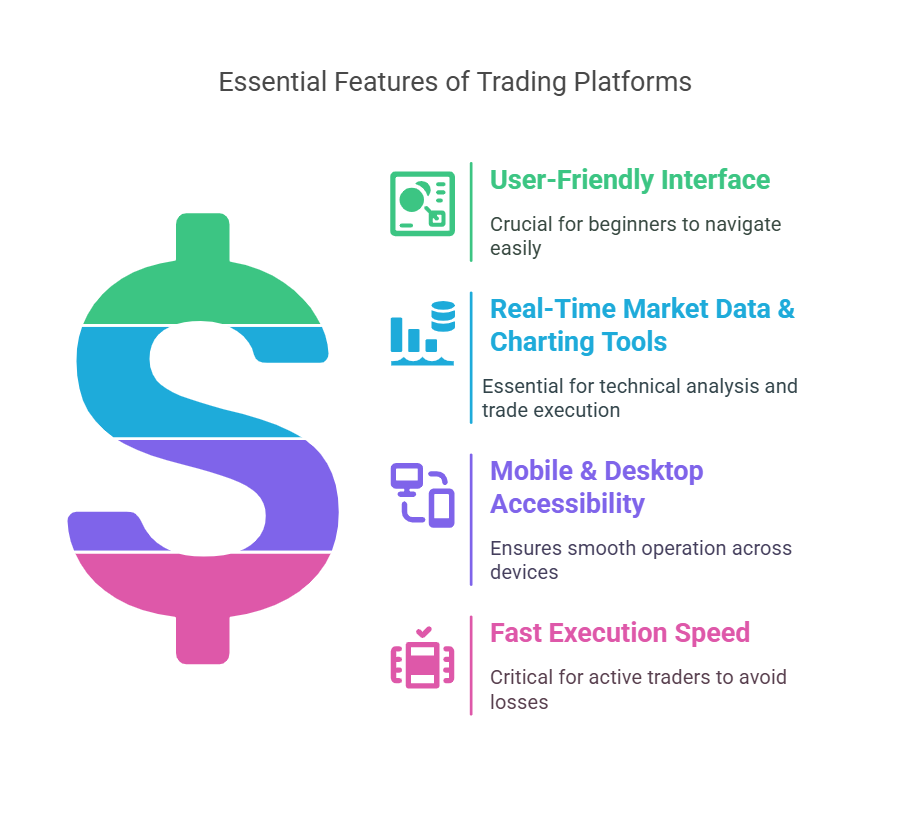

A broker’s trading platform can significantly impact your experience, so look for one that offers:

💡 Tip: Test the broker’s demo account (if available) to get a feel for the platform before committing.

4. Regulatory Compliance & Security

Regulatory compliance ensures that your broker is trustworthy and operates under strict financial guidelines. In Malaysia, all brokers must be licensed by the Securities Commission Malaysia (SCM).

Security is another vital aspect—look for brokers that offer:

- Two-Factor Authentication (2FA) – Adds an extra layer of protection to your account.

- Encryption & Fund Protection – Ensures your personal and financial data is secure.

- Investor Protection Policies – Some brokers provide compensation in case of insolvency.

💡 Tip: Always verify a broker’s regulatory status on the Securities Commission Malaysia website before opening an account.

5. Customer Support & Educational Resources

A broker with reliable customer service can make a huge difference, especially during market volatility. Consider:

- Support Channels – Do they offer live chat, phone support, or email assistance?

- Broker-Assisted Trading – Can you reach a representative for help with trades?

- Educational Materials – Webinars, tutorials, and research reports can be valuable for improving your trading knowledge.

If you’re new to investing, a broker that offers strong educational support can be a great advantage.

Comparing the Top Online Brokers in Malaysia

With the above factors in mind, here’s how the leading online brokers in Malaysia stack up:

| Broker | Trading Fees | Market Access | Platform Features | Customer Support |

| Broker A | RM8 per trade | Bursa Malaysia, US, HK | Advanced charting, mobile app | 24/7 live chat |

| Broker B | Zero-commission | Bursa, US, Forex | Simple interface, automated trading | Email support only |

| Broker C | RM10 per trade | Bursa, ETFs, Bonds | AI-powered market insight | Phone support & chat |

The best broker depends on your priorities— low fees, market access, advanced tools, or support. Compare features to find the right fit for your trading needs.

Choosing the Right Broker Based on Your Trading Style

Choosing one of the best trading broker in Malaysia for you depends on your trading strategy and investment goals:

If you’re wondering how to open a trading account in Malaysia, most brokers allow you to open a trading account online with a straightforward registration process, requiring your IC, proof of address, and initial deposit.

Trade with Confidence

Selecting the right investment company in Malaysia is a critical step in your investment journey. By considering factors such as fees, market access, platform features, regulatory compliance, and customer support, you can find a broker that aligns with your trading needs.

Whether you’re an active trader or a long-term investor, Phillip Capital offers a secure, cost-effective, and feature-rich trading account in Malaysia experience.👉 Discover exclusive ongoing campaigns and trade with confidence on Phillip Capital’s secure online trading platform—your gateway to smarter investments!