Futures trading is a versatile and dynamic way to invest in financial markets. It offers opportunities to profit from price changes while managing risks.

In our previous article, we covered the basics of futures trading for beginners. You’ve grasped the fundamentals like what futures contracts are, how they work, and the benefits of trading in key Malaysian markets.

Now, it’s time to take a step forward. This intermediate guide on futures trading in Malaysia will dive deeper into advanced concepts like margin management, spread trading, and popular trading strategies.

We will also discuss essential risk management techniques and how Phillip Capital’s platform can support your journey into trading on a higher level.

Introduction to Advanced Futures Trading Concepts

As an intermediate trader, you need to master more complex concepts that can help improve your trading performance. Here are two areas that you can focus on:

Margin and Leverage Management

When trading futures, you are required to maintain a margin. It acts as a security deposit to cover potential losses. There are two types of margins:

- Initial Margin: The amount of deposit required to open a position.

- Maintenance Margin: The minimum balance you must maintain in your account to keep your overnight position.

If the balance of your futures trading account in Malaysia falls below the maintenance margin due to unfavorable price movements, you will receive a margin call. Phillip Capital will inform you of the margin call amount, after which you’ll be required to add funds to bring it back to the required level or risk having your position automatically closed.

Effective leverage management plays a crucial role in this. Leverage allows you to control large positions with a smaller capital outlay. The caveat is that it is a double-edged sword, as this will amplify both potential gains and losses.

A good rule of thumb is to use only moderate leverage. This will keep a buffer for unexpected market shifts. For example, if crude oil prices experience a sudden spike, you’ll be prepared to cover potential margin increases without triggering a margin call.

Futures Spread Trading to Minimize Risk

Spread trading is an advanced technique that can help you manage risk while profiting from price differences in related contracts. You do this by taking two opposite positions in related contracts, either within the same market or across different markets.

There are two types of spreads:

- Inter-Commodity Spreads: This is when you trade futures contracts of different but related commodities. For example, you might go long on crude oil and short on natural gas, expecting that the price relationship between the two will change.

- Intra-Commodity Spreads: Here, you take positions on the same commodity but in different contract months. For example, you could buy a July CPO contract and sell a September CPO contract, anticipating a price difference between the two delivery months.

Spread trading helps reduce outright risk because the price movements in one position are often balanced by the opposing position. Say you’re trading crude oil and natural gas. If oil rises and gas falls, your positions offset each other, effectively limiting the overall risk. It is a practical strategy for intermediate traders trying to manage volatility.

Popular Intermediate-Level Futures Trading Strategies You Should Know

As you advance in your futures trading journey, you’ll want to explore more sophisticated strategies. The following approaches will help you navigate different market conditions and improve your chances of success.

1. Hedging

Hedging is a vital strategy used by both companies and professional traders to protect against adverse price movements.

For example, palm oil producers in Malaysia often hedge their output by locking in future prices, ensuring they’re not hit by sudden market drops. Similarly, airlines may use crude oil futures to shield themselves from rising fuel costs.

To hedge effectively, you need to understand the underlying market forces that influence price. By aligning your positions with your risk tolerance, you can minimize losses while continuing to capture gains.

2. Swing Trading

Swing trading is a popular short-term trading strategy that involves capitalizing on price “swings” in unpredictable markets. Instead of holding positions for the long term, swing traders aim to capture profits from short-term price movements.

You can rely on technical analysis tools like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to identify entry and exit points.

- RSI helps you determine whether an asset is overbought or oversold, signaling potential reversals.

- MACD is a trend-following indicator that helps you identify momentum shifts to generate clear buy and sell signals.

For instance, if you’re swing trading CPO futures and the RSI indicates the market is overbought, you might prepare to exit your long position and take a short position, expecting a price reversal.

Swing trading is ideal for intermediate traders who prefer a more active approach and are comfortable making quick decisions based on market trends.

3. Trend Following

Following trends is a valid tactic when learning how to trade futures in Malaysia. It involves identifying and trading in the direction of long-term market fads. This approach works particularly well in futures markets like commodities and indices, where trends can persist for extended periods.

By using tools like moving averages or breakout strategies, you can time your entry and exit points. In the event that crude oil prices are on an upward trend, you would enter the market once the trajectory is confirmed and exit when it shows signs of reversal.

Risk Management Techniques to Protect Your Futures Trading Account in Malaysia

The reality is that any form of investment comes with risks. Proper management techniques will protect your capital and avoid unnecessary exposure to market fluctuations.

Position Sizing and Risk-Reward Ratios

One of the most important aspects of risk management is determining your position size. As an intermediate trader, you should base your position size on your account size and risk tolerance. A common rule of thumb is to never risk more than 1-2% of your total account balance on a single trade.

Additionally, setting risk-reward ratios helps you determine whether a trade is worth taking. For example, if you are willing to risk RM200 on a trade, you should aim for a reward of at least RM400, setting a 1:2 risk-reward ratio. This way, even if you lose half of your trades, you still stand to gain more than you lose over time.

Stop-Loss and Take-Profit Orders

Using stop-loss and take-profit orders is a simple yet smart way to manage risk. It automates your trades and controls your risk exposure.

A stop-loss order automatically closes your position once the price reaches a predetermined level to limit your losses. A take-profit order does the opposite by closing your position once the price hits your set target to lock in your gains.

If you’re long on natural gas futures, you can set a stop-loss to exit the trade if prices drop by 5%, while your take-profit order automatically locks in gains if prices rise by 10%. By setting these orders, your decision-making will be less driven by emotions or impulses.

Diversifying Your Portfolio Across Futures Markets

Diversifying your portfolio across different futures markets such as:

- Commodities like Crude Palm Oil, Gold, Natural Gas, Soybean, Corn, etc.

- Indices like KLCI, China A50, Dow Jones, Hang Seng, Nikkei, etc.

By not putting all your capital into one market and spreading your investments across multiple asset classes, you reduce your exposure to market-specific volatility. Suppose the crude oil market is experiencing high volatility, balanced positions in more stable markets like gold or global indices can help offset losses.

Leveraging Phillip Capital’s Trading Platform

Now that you’ve reached the level of an intermediate trader, you’ll want a trading platform in Malaysia that feels just right. Our platform has all the advanced tools and features designed to meet your needs.

Advanced Order Types for Precise Trade Management

Our platform offers several advanced order types to help you manage trades with precision. These include:

- Limit Order: Ensure that you only buy or sell at your desired price or better.

- OCO Order: Also known as One-Cancels-the-Other Order, it is a pair of conditional orders where one order automatically withdraws the other when it executes. OCO orders are often used to control risk in volatile markets.

- GTC Order: Also called Good-Til-Canceled Order, it is a trading instruction that remains active until it is executed or canceled by you.

Phillip Nova Platform: Tools and Insights Made For You

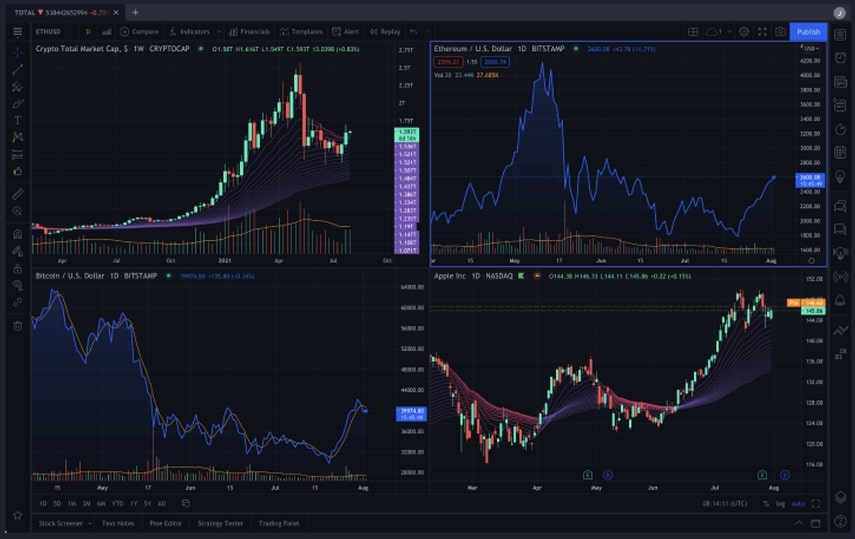

The Phillip Nova platform is designed to support intermediate traders with modern tools, compatible charting systems, and in-depth research. With access to live charts, spread trading features, and single-account access to global markets, we equip you with everything you need before you start trading.

Educational Support for Intermediate Traders

Phillip Capital provides a wealth of educational resources, including webinars, seminars, and tutorials. Take advantage of our educational resources to expand your knowledge and stay ahead of market trends. You’ll also gain premium access to the latest industry news and tools available.

Learn How to Trade Futures in Malaysia in the Best Ways with Phillip Capital

As you progress to intermediate-level futures trading, it’s important to adopt more advanced strategies, manage your risk effectively, and make smart use of the right tools to succeed.

Whether you’re swing trading, following trends, or hedging your portfolio, the techniques covered in this guide will help you take your trading to the next level.

Phillip Capital is an investment trading company in Malaysia and one of the best futures brokers in the country. We offer everything you need to implement these strategies with confidence.

Sign up for a demo account today, and start applying these intermediate futures trading strategies to improve your futures trading account in Malaysia and grow your portfolio.

You can also reach out to us for more informative guides on all things trading and investments.