Trade Futures: Manage Risk with Hedging, Capitalize on Speculation, and Exploit Opportunities through Arbitrage

Gain access to futures across the globe including from Japan, Hong Kong, Malaysia, Singapore and US markets. Below are the types of futures available with Phillip Capital

Click here to view our full Futures offerings.

A futures contract is a standardized agreement, made on the trading floor of a futures exchange, to buy or sell a predetermined quantity and quality of a specified commodity or financial instrument at a future date.

In the futures trading industry, a commodity is an article of commerce or a product that leads itself to standardization for the purpose of futures contract. Types of commodity include certain agricultural products (such as wheat, soybeans, cotton, sugar, cocoa), metals (gold, silver, platinum), and petroleum (crude oil).

A futures exchange is association of persons who participate in the business of buying and selling futures contracts or futures options. There are futures exchanges all over the world.

To get started you need to open an Individual Account with the following process:

*For Corporate account opening, please contact 03-9212 2820/03-2162 1628

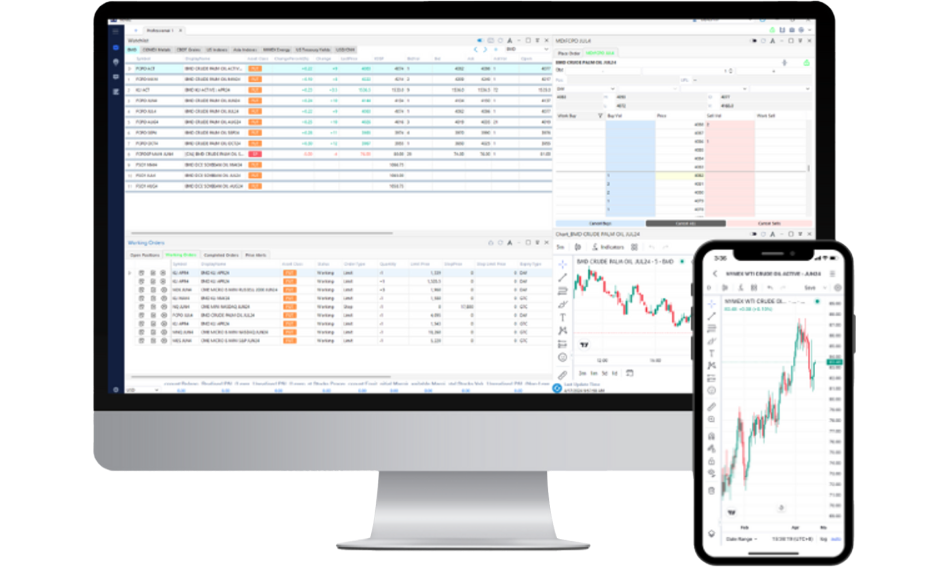

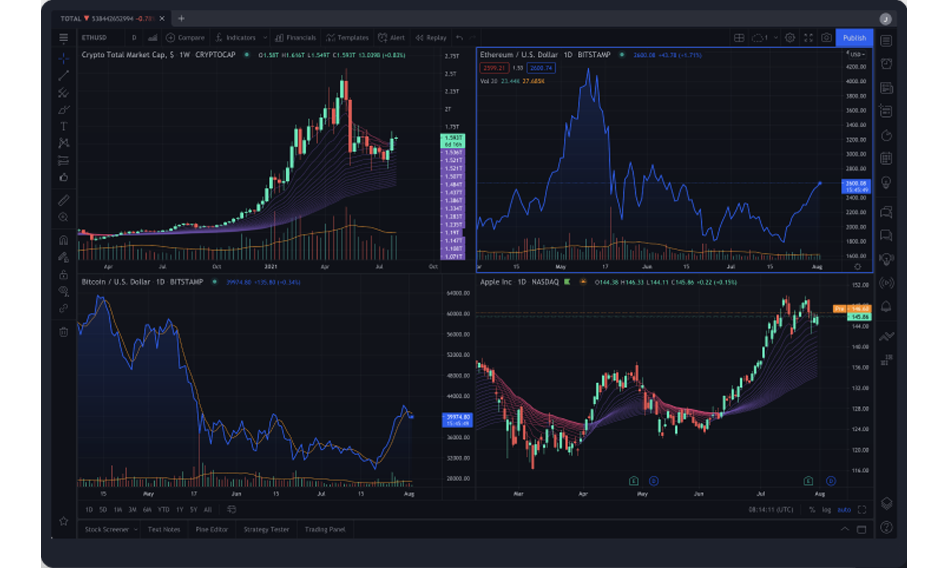

Yes, Phillip Capital offers free charting tools integrated in our Phillip Nova trading platform. This service is provided as value added to our clients. Our clients will enjoy free live charting tools if they trade with us.

Futures is used for the purpose of Hedging, Speculation and Arbitraging.Hedging is using futures limiting the risk that arises from large fluctuations in prices. It is a form of insurance to prevent adverse price movement. Taking a futures position opposite to the current physical position held.Speculation deals with changes in the expect price levels overtime and do not own physical delivery. They speculate profit from futures trading by buying contracts at lower price and selling at a high price. Arbitraging is simultaneous purchase and sell of the same instrument in different market to profit from price discrepancies.

We provide the following services to our clients:

Mastering the Art of Futures & Commodity Trading in Malaysia

Excelling in futures trading in Malaysia and navigating online commodity trading platforms can be challenging, but with the right strategies and tools, it can be highly rewarding. At Phillip Capital Malaysia, we provide traders with a powerful suite of tools to help them navigate the complexities of the market and gain a competitive edge in futures and commodities trading in Malaysia.

With access to a wide range of global investment products, including index, metal, agricultural, and energy futures, our trading platform Phillip Nova is designed to give you the competitive edge. Whether you’re a beginner or expanding your portfolio to trade futures Malaysia, we offer the resources and guidance to help you thrive.

Trade Futures & Commodities Trading with Confidence at Phillip Capital Malaysia

As a leading platform for futures and commodity trading, Phillip Capital Malaysia ensures you have the suitable tools before you start trading. In addition to commodity trading in Malaysia, we also offer a comprehensive service for those looking to trade stocks in Malaysia and diversify their portfolios.

Our Phillip Capital trading platform simplifies the trading experience, making it easy to monitor positions, execute trades, and access valuable market insights. Whether you’re trading from home or on the go, you can trust Phillip Capital to streamline your futures trading in Malaysia journey. Open an account today and start trading with confidence.

B-18-6, Blok B Level 18 Unit 6, Megan Avenue II, Jalan Yap Kwan Seng, 50450, Kuala Lumpur | Copyright © 2025. All Rights Reserved.

Phillip Capital Sdn Bhd | A member of PhillipCapital | Company Reg No: 199501033331 (362533-U)

Phillip Capital Sdn Bhd (362533-U) holds a capital markets services license, from the Securities Commission Malaysia (SC), for dealing in capital market products such as futures, stocks & contract for differences (CFD).

Trading in leveraged financial instruments carries substantial risk, and is not suitable for all investors as it can result in losses exceeding deposits or principal amount, therefore please ensure that you fully understand the risks and costs involved by reading our Risk and Disclosure Statements and Disclamer.

For more information on how we handle your personal information, please refer to our Privacy Policy.

This advertisement has not been reviewed by the Securities Commission Malaysia.